Categories

- Country (113)

- Deportes (6)

- Fútbol (2)

- Docencia (77)

- Competividad (1)

- Dinero (7)

- Familia (3)

- Freedom of Speech (1)

- Games (1)

- Gobierno Abierto (4)

- Justicia y Leyes (7)

- Music (4)

- Open Source (15)

- Privacidad (1)

- Religion (1)

- Salud (17)

- Sistema Educativo (8)

- Smart City (9)

- Soluciones (1)

- eLearning (1)

- Money, Sex & Power (15)

- Bitcoin Price (1)

- Bussiness Model (5)

- Science & Technology (67)

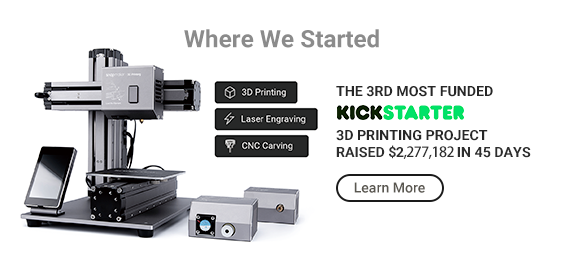

- 3D Printing (1)

- Artificial Intelligence (6)

- Augmented Reality (2)

- Autopilot (4)

- Blockchain (5)

- Hardware (1)

- Plataform (5)

- Programming (7)

- Robot (2)

- Software (22)

- Tools (2)

- Video Games (5)

- Water (1)

- Uncategorized (798)

- World (83)

- Airlines (4)

- Corruption $ Debt (8)

- Ecology & Polution (3)

- Economics (16)

- Energy (4)

- Farmaceutica (1)

- Financial System (1)

- Food (8)

- Graph & Charts (2)

- Health (23)

- Knowledge (5)

- Maritime (2)

- Military (5)

- Religion (2)

- Traffic (3)

- Transporte (2)

- Water (2)

Tags

3D Kit (4) Abandonware (2) ACP (2) Alan García (2) APRA (2) BeOS (16) Centos (2) Corona Virus (4) CriptoChico (3) Cuello (2) Download (3) Drone (2) Emulator (5) Facebook (6) Foul (3) Fútbol (2) Hackintosh (5) Hayek (2) Hemp (2) IDAAN (2) Linux (3) LiveCode (2) LoRaWAN (2) MacOS (4) Market Capitalization (4) Odoo (11) Ollanta Humala (2) Orthotropics (2) PowerPC (3) Revolution (6) Robot (2) Snap (2) StarCraft II (3) Tesla (2) Tools (4) ToScrap (3) Trigger Point (12) Uber (4) Virtual Machine (3) Water Treatment Solutions (2) Water War (3) WebSite (9) WEF (2) Wish List (2) WordPress (3)-

Recent Posts

Recent Comments

[2014-10-03] The Secrets of Sugar – the fifth estate – CBC News

We’ve heard for years about the dangers of eating too much fat or salt. But there have never been recommended limits for sugar on Canadian food labels, despite emerging research that suggests the sweet stuff may be making more of us fat and sick. In the fifth estate’s season premiere, Gillian Findlay digs into the surprising science — and the reaction from the food industry — to reveal The Secrets of Sugar. Has the sugar industry been hiding an unsavoury truth from consumers?

A small but influential group of medical researchers is stirring up the health debate, linking sugar not just to rising obesity rates but also to a host of diseases including cancer, heart disease and Alzheimer’s.

We put a family of four on a healthy diet to try to beat their sugar habit and track the surprising results. We talk to leading scientists – and their critics. And we ask the food industry why those ingredient labels are far from clear when it comes to how much sugar is really on your plate.

Original airdate : October 4th, 2013

[2020-01-14] Why Presidential Speeches Are Getting “Dumber” – Cheddar

Readability Formula

The reading levels of American presidential speeches have been on a steady decline since the 1920’s. The answer has less to do with the president and more to do with who they are speaking to.

Further reading:

1: The Atlantic

https://www.theatlantic.com/politics/…2: Readability Formula

https://readabilityformulas.com/freet…3: Towards Data Science

https://towardsdatascience.com/a-quick-dip-in-presidential-rhetoric-or-a-permanent-plunge-fda7f3cc26254: Brown University

http://brownpoliticalreview.org/2016/…

Posted in Artificial Intelligence

[2019-01-21] full interview with legendary investor Paul Tudor Jones at Davos – CNBC

Paul Tudor Jones, chairman of JUST Capital and chief investment officer of Tudor Investment Corporation, joins “Squawk Box” to discuss the markets, interest rates, the world economy and more.Billionaire investor Paul Tudor Jones said the stock market today is reminiscent of the latter stages of the bull market in 1999 that saw a giant surge that ultimately ended with the popping of the dot-com bubble.“We are just again in this craziest monetary and fiscal mix in history. It’s so explosive. It defies imagination,” Jones said on CNBC’s “Squawk Box” on Tuesday at the World Economic Forum in Davos, Switzerland. “It reminds me a lot of the early ’99. In early ’99 we had 1.6% PCE, 2.3% CPI. We have the exact same metrics today.”“The difference is fed funds were 4.75%; today it’s 1.62%. And back then we had budget surplus and we’ve got a 5% budget deficit,” Jones added. “Crazy times.”Asked if investors should sell now to avoid a blow-up like the one that took place in March of 2000, Jones said, “Not really. The train has got a long, long way to go if you think about it.”The legendary hedge fund manager and trader noted that the Nasdaq Composite more than doubled from a similar stage to the dot-com bubble top. “That’s a long way from now. At the top theoretically, rates [would] be substantially higher.”The stock market hit a peak in 2000 before the dot-com bubble burst. The tech-heavy Nasdaq Composite approached 5,000 in early 2000 then dove thousands of points, crushing investors.Jones, founder and chief investment officer of Tudor Investment Corporation, warned that the new “curveball” to derail the bull market could be the outbreak of the coronavirus.“That’s a big deal. If you look at what happened in 2003 … stock markets sold off double digits. If you look at the escalation of the reported cases, it feels a lot like that,” Jones said. “There’s no vaccination. There’s no cure. … If I was an investor, I’d be really nervous.”The virus, stemming from Wuhan, China, has killed six people with confirmed cases in China totaling nearly 300 as of Monday, less than a week before Lunar New Year, when millions of Chinese travel at home and abroad.The Centers for Disease Control told Reuters Tuesday that a traveler from China was diagnosed with the first U.S. case of coronavirus in Seattle.

Posted in Economics

[2020-01-21] ‘Cash is trash’ in the 2020 market: Bridgewater Associates founder – CNBC

Ray Dalio, founder of Bridgewater Associates, joins “Squawk Box” at the World Economic Forum in Davos to discuss what he’s watching in the markets for 2020.Ray Dalio, founder of investment firm Bridgewater Associates, said Tuesday that he thinks investors shouldn’t miss out on the strength of the current market and that they should dump cash for a diversified portfolio.“Everybody is missing out, so everybody wants to get in,” Dalio said on CNBC’s “Squawk Box” at the World Economic Forum in Davos, Switerzland.Dalio advised having a global and well-diversified portfolio in this market and said the thing people can’t “jump into” is cash.“Cash is trash,” Dalio said. “Get out of cash. There’s still a lot of money in cash.”Dalio’s firm, Bridgewater, manages about $160 billion. His declaration that investors should not stay on the sidelines is one he’s made before, as in 2018 he declared that those holding cash were “going to feel pretty stupid” for missing the market’s run-up.“You have to have balance … and I think you have to have a certain amount of gold in your portfolio,” Dalio said, reiterating his call last year that the precious metal will be a top investment in the years to come.While he endorsed buying a bit of gold, he warned against more speculative investments like bitcoin.“There’s two purposes of money, a medium of exchange and a store hold of wealth, and bitcoin is not effective in either of those cases now,” he said.Dalio’s warning for the next five yearsDalio doesn’t think there will be an economic downturn this year and he said investors should look beyond the 2020 U.S. presidential election.“If you get a downturn – and there’s a good probability in the next [presidential] term you’ll get a downturn – and you don’t have effective monetary policy and you have people at each other’s throats, I’m worried about that,” Dalio said.“I would say there’s a 20% chance every year [of a downturn],” he added.Dalio believes the Federal Reserve is now in a position where it can no longer stimulate the U.S. economy like has in the past, notably by lowering interest rates.“You used to push a button and it would go up,” he said.But if U.S. interest rates continue to fall, and politics remain highly divisive, Dalio worries that the economy won’t be able to bounce back like it has in the past.“We’re going to have larger deficits which we’re going to print money for,” Dalio said. “At a point in the future, we still are going to think about what’s a store holder of wealth. Because when you get negative-yielding bonds or something, we are approaching a limit that will be a paradigm shift.”

Posted in Economics

[2020-01-22] Bridgewater Co-CIO Prince Calls the End of the Boom-Bust Cycle – Bloomberg

Jan.22 — Bob Prince, co-chief investment officer at Bridgewater Associates, discusses the end of the boom-bust cycle, finding opportunity in market stability, and the firm’s investment strategy. He speaks at the World Economic Forum’s annual meeting in Davos, Switzerland on “Bloomberg Surveillance.”

Posted in Economics

Royalty free music and sound effects | Epidemic Sound

Struggle with music licensing for video, film or YouTube? Our library is of the highest quality, usable on all social platforms and royalty-free forever.

Source: Royalty free music and sound effects | Epidemic Sound